The tariffs imposed by 45th and 47th president Donald J Trump are a contentious topic, especially for people who don’t know how Tariffs work. It may be difficult to visualize in what ways these Tariffs affect you, your breakfast, or your job.

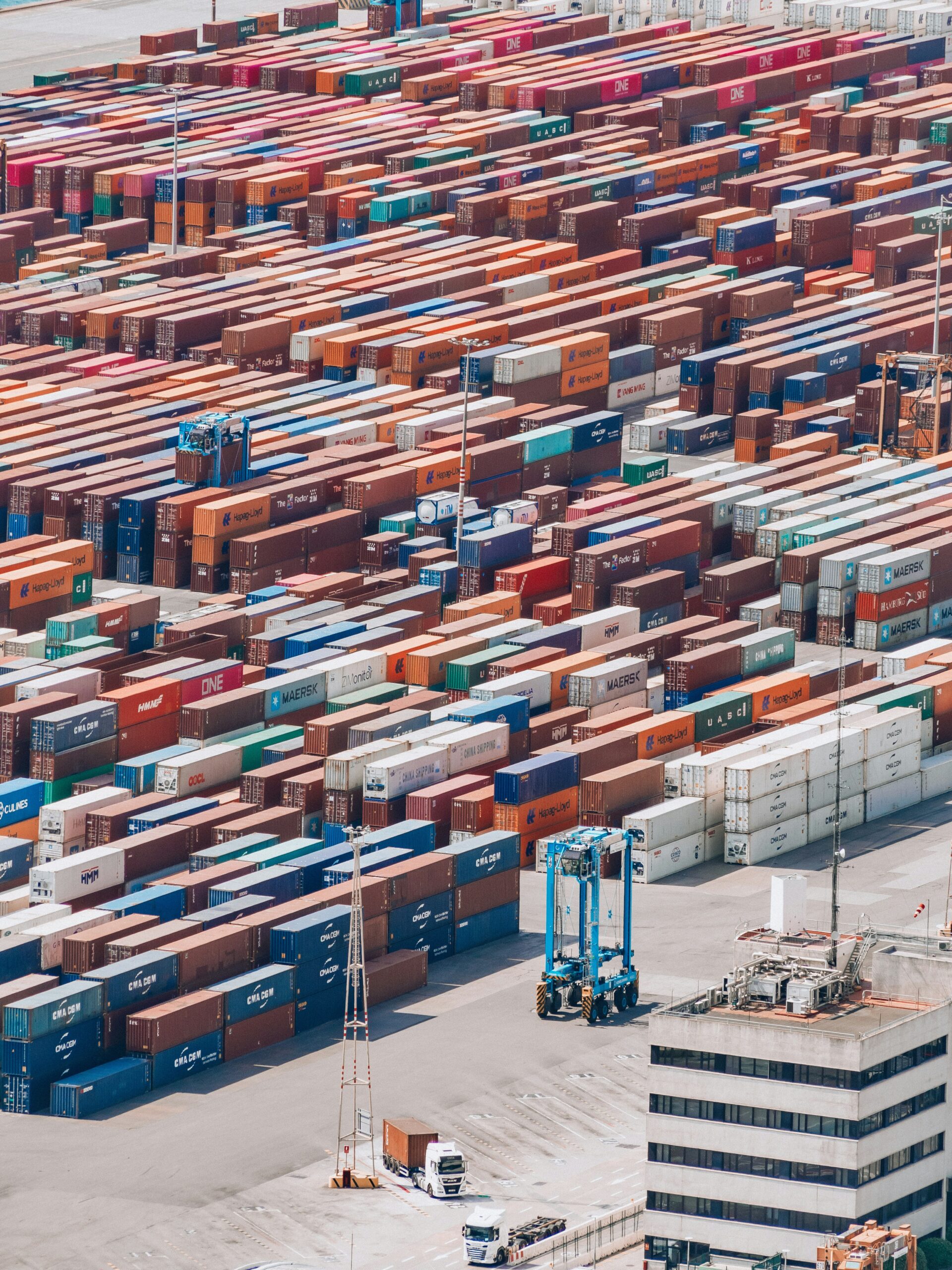

A tariff is a type of tax, used to increase benefits from trade by raising prices for any exports sent to a given country. An import is a selection of items or materials that are brought in from other countries. These can range in both the amount of percentage added, what items are taxed, and where they are taxed from. So, if there is a 50% tax on an item that costs $100, the added value of the item to the country that imposed the tariff will be the original price plus half of the price. This means your $100 item is now a $150 item, which means you will be spending $50 more. Now, this cost is placed on the country that received the tariff, not the country which imposed it. This serves many functions; these surcharges can raise money from countries which may rely on exports. They could also serve to deter countries from exporting, which can help local businesses to compete against overseas businesses.

To visualize a Tariff, it’s best to correlate it with a familiar topic; breakfast! Think of this, you go to your local chain supermarket, and buy a tray of eggs for $5, sausage for $3, and cheese for $2. You purchase these items for a total of $10, plus $0.50 in 5% sales tax. You return home, kick off your shoes and slip into your pajamas, and prepare yourself a standard breakfast for tomorrow. As you slip into bed, you decide to open the local news channel. In the broadcast, they state that your current president has decided to impose import taxes on many items.. The president intends to impose a 10% tax on all imports from the United Kingdom, where all of your breakfast items are imported from. While tariffs don’t directly impact your grocery prices, they do affect the bottom line of your local supermarket. If the UK decided to export less of these items, the businesses who benefit from them may raise prices to compete with the sudden lack of supply. If you’re local supermarket adds a 10% tax on these items to cover the cost, each item will cost 110% of the original price; your cheese is now $2.20, your sausage is now $3.30, and your eggs are now $5.50. These add up to a total of $11, a dollar more than what you would’ve usually spent. You also need to factor in sales tax; 10% added on $11 means you are now charged a total of $11.55. And this is just your breakfast. If you wanted to buy a $50 video game, which is also an import from the UK, the supermarket may charge a total of $55, plus tax. A $200 laptop is now $220, plus tax.

Tariffs are meant to raise gain from trade for a country. However, these are delicate things, which may cause further increased prices for not only businesses, but also the consumers which buy from them, and could tense relations with the countries where a tariff is imposed *wink wink nudge nudge*.